Booming Beauty.

Cosmetics and Beauty brands are taking over e-commerce.

The cosmetics and beauty industry are growing rapidly and sees no sings of stopping.

Traditionally, Peak season (which is just around the corner) is the time of the year when cosmetics are sold online in large quantities. Whether it’s a new shampoo for a fresh new fall hair color, glittery powders and liners, or skin care to help our outer dermis protect from the colder weather and winter sun, we all seem to fill up our web-shopping baskets with cosmetic products. This Booming Beauty special on cosmetics explores the latest data on the category growth and its shoppers.

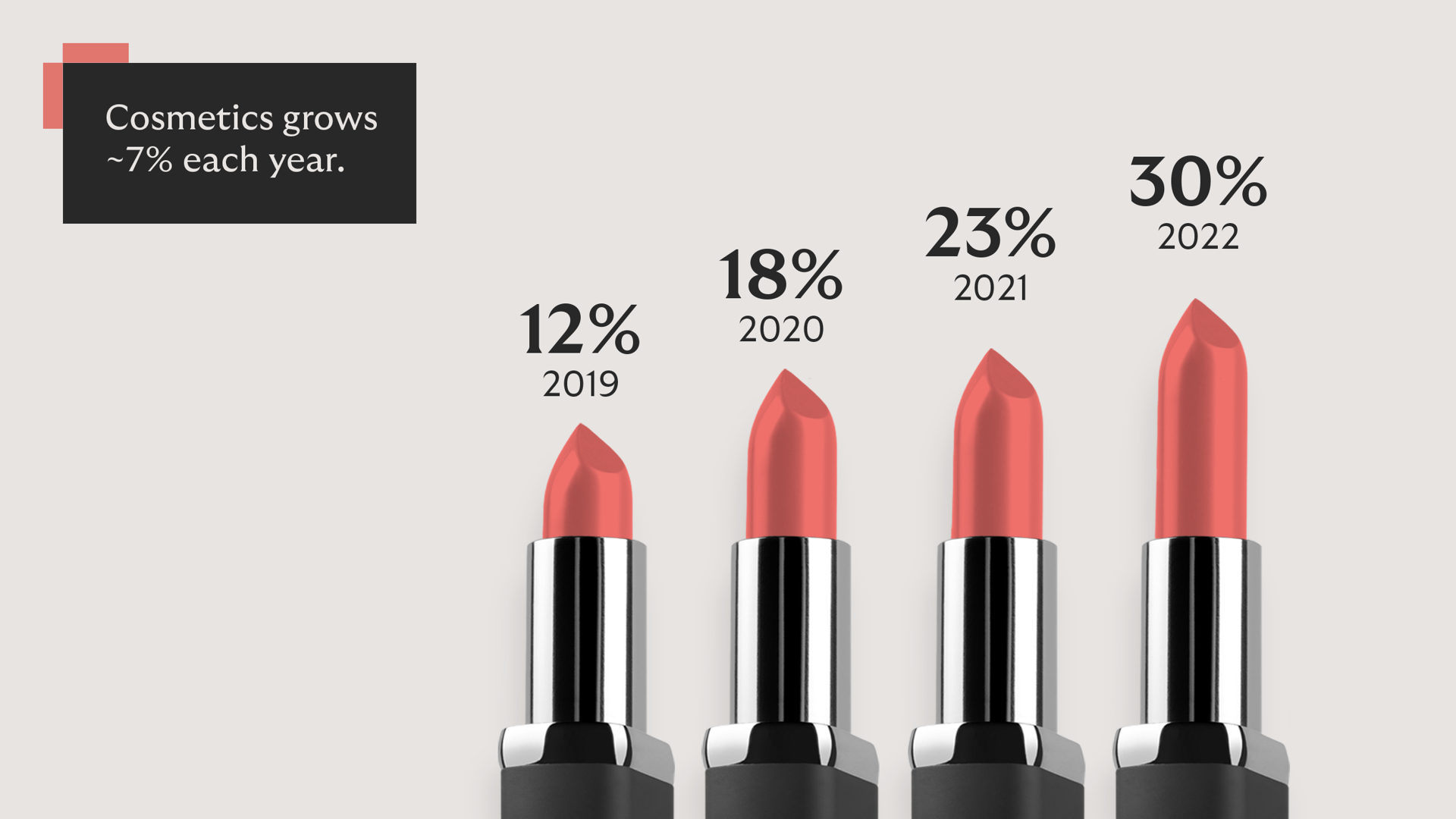

The online category of cosmetics looked very different 2.5 years ago. The majority of the shoppers got their beauty and body care products from a physical, and thus offline, place. The virus that changed the world, also shook up the world of cosmetics. With shops closed, consumers flocked online to get their beloved regimen products as well as items that fit the new trend for self-care (and) well-being. That experience lowered the threshold for many shoppers. Suddenly, buying cosmetics online turns into a normality. Whereas before in 2019, only around 12% of all online retail was represented by cosmetics. Now two years down the line, the category grew immensely with 30%. Other statistics show that prior to the pandemic, 51% of shoppers made at least once a purchase online in this category, versus a 65% of consumers in 2022.

Convenience comes in many ways:

Experience, assortment, channels, and tech developments.

The newfound easy shopping experience for this category online is supported on many different levels. Since the demand is growing, as is the online assortment and availability. Trusted cosmetics, supplements and vitamins, hygiene products and over-the-counter medicines are more available than ever. Not only in wider ranges, but also in wider quantities as merchants are getting better and better in their online supply chain.

The offering of payment methods is becoming more diverse, too, for buying cosmetics online. Cosmetics shoppers want Buy Now Pay Later.

Cosmetics shoppers use significantly more BNPL in their online check out screens. In the share of purchases using BNPL is 24% among cosmetics shoppers and 20% among all online shoppers.

The demand for cosmetics is unstoppable. Luckily the online realm is also developing rapidly.

The role of social media is bigger than anyone could ever imagine. Filters in Instagram and AR tools in webshops are now driving force of selling cosmetics. These virtual tools that can be applied for trying (or “swatching”) cosmetics are used by shoppers in all age brackets. Just take a selfie or record a little video to see how the products match up to your skin in the virtual try on. All these virtual tools are developed for the mobile device. Especially the younger generation is causing for a more and more skewed divide of mobile vs desktop shopping. Almost 3 out of 4 (71% in 2021) purchases is done on a mobile device vs on a computer or laptop.

Social media and social commerce drive the category

Social commerce is the advertising and selling of products, using social media as a platform. Users browse and buy products without leaving the social media environment. This way of commerce is now the number one push to selling cosmetics online. Over 85% of all online cosmetics traffic comes from social media platforms, such as Facebook, Instagram, YouTube, and Snap Chat. Both branded channels as well as influencers sell items to their audiences. But cosmetics are not solely bought on the social platforms. There is a wide spread of purchases divided over the webshops of online drugstores, specialty shops and bigger online one-stop-shop marketplaces.

If only the consumer Satisfaction was as high as the sales

Consumer satisfaction is not growing as rapidly as the sales in the category itself, unfortunately. From all cosmetics-consumers who shop online, the relatively high dissatisfaction comes down at 6% (vs e.g., Media Entertain and Petfood 71% and 60% respectively). Colors, textures, and coverage are tricky to see online vs what they look like in real life on skin. However, the special AR tools and filters may hopefully cause for a change in satisfaction sometime soon.

The look of a cosmetics shopper

Cosmetics shoppers have an average age of 41.7 years old. That makes them a little bit younger than shoppers in general, who are 45.3 years old on average. The age brackets, however, are evenly distributed with exactly 50% under the age of 50, and 50% over the age of 50. The overall shopper age is slightly more skewed towards the over 50 years old (59%). But we do need to add nuances here. It is especially the women who are avid online cosmetics shoppers, compared to males. Although men’s cosmetics are in the lift with an average annual growth of 6% and covid-19 as a strong catalysator, they are still underrepresented in the share (26% men vs 74% women) of sexes online shopping for (health)care and beauty products online.

Cosmetics shoppers want Buy Now Pay Later

Cosmetics shoppers use significantly more BNPL in their online check out screens. In the share of purchases using BNPL is 24% among cosmetics shoppers and 20% among all online shoppers. Cosmetics shoppers are more likely to be Heavy shoppers (32% compared to overall shoppers 18%). Most cosmetics shoppers are medium shoppers, as they make 4-8 online monthly purchases, just like most of the online shoppers.

Other appealing categories to shop in for cosmetics shoppers:

- Fashion

- Food

- HealthFood

- Takeaway Food

- Media Entertainment

Cosmetics shoppers are a little more adventurous and try new online shops more often than the overall online shoppers.

The amount over average online purchases is also higher: 4.2 online purchases for cosmetics shoppers, vs 3.1 online purchases for the average online shoppers.

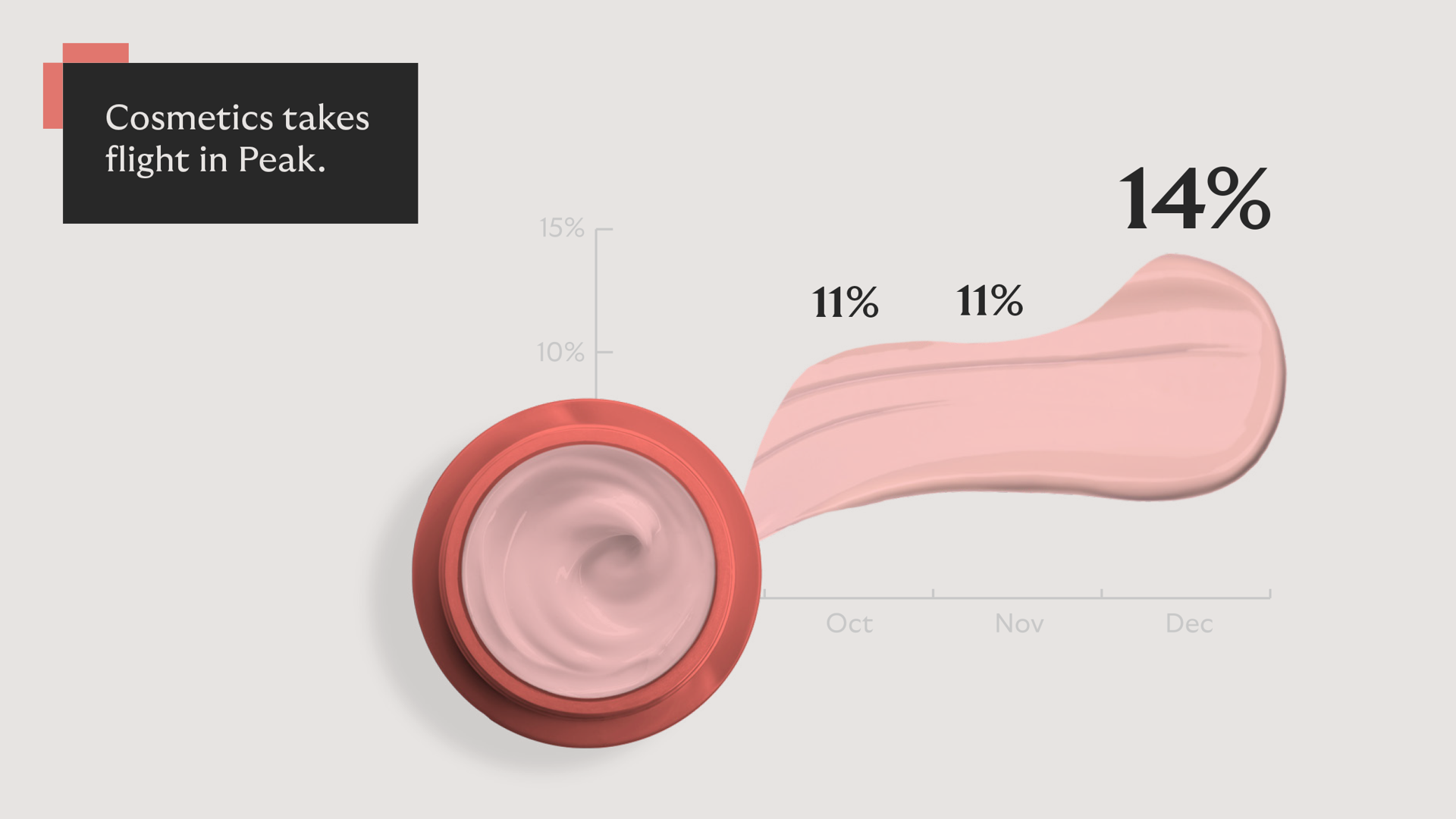

Cosmetics take a flight in Peak season

On the flipside, all these cosmetics shopper purchases have a lower basket value, with an average of 53.50 euros per purchase (vs 65.40 euros for the average online shoppers). A lower basket value is a normal occurrence when the online purchases per month are higher. The lower the basket value, the higher the purchases, and vice versa. With the upcoming Peak season this will be even more visible as consumer shop more online in general, which causes the drop in basket value.